07 Nov

Want to expand your online business internationally? Now it has become easier to expand internationally in recent years because of Shopify multi-currency feature. Expanding internationally is an obvious path to revenue growth.

What is Shopify Multi-Currency?

Shopify multi-currency lets you choose the currencies you want to offer on your store, from a list of over 130 global currencies including:

- Australian dollar (AUD)

- Canadian dollar (CAD)

- Denmark Krone (DKK)

- Euro (EUR)

- Hong Kong dollar (HKD)

- Japanese yen (JPY)

- New Zealand Dollar (NZD)

- Pound Sterling (British pound) (GBP)

- Singapore Dollar (SGD)

- United States Dollar (USD)

Showing the Right Currencies

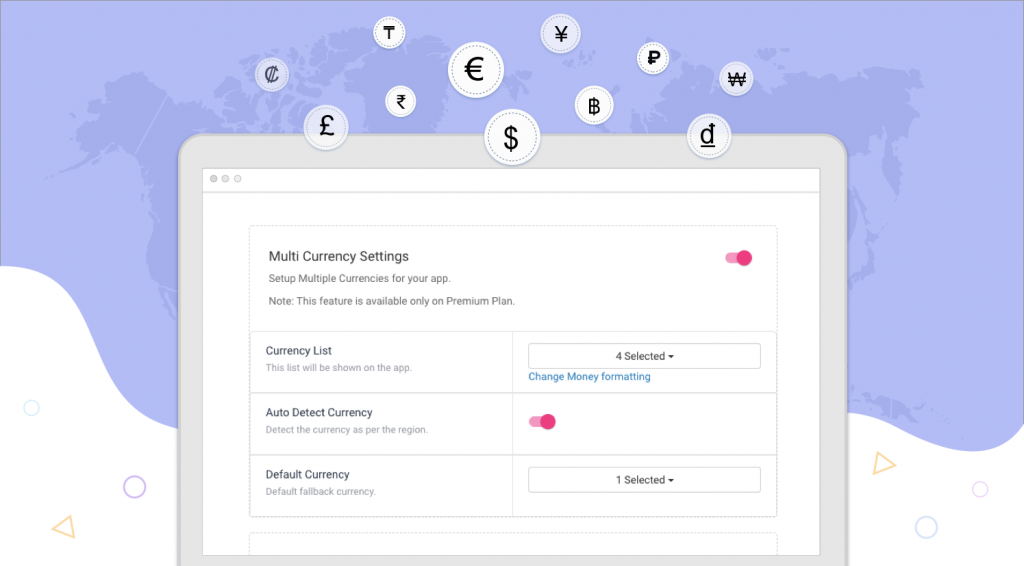

Throughout the customer’s purchase journey, from the homepage to checkout confirmation, customers can shop in their local currency. To show these currencies to relevant customers, merchants have a few options.

Letting the Customers Choose their Currency

You can let your customers choose their currency; all you have to do is to add Currency-Switcher to your Shopify Theme and customers can choose their preferred currency once landed on your store.

Detecting Customer’s Location

You can also use build in geo-IP detection, it will automatically recommend the relevant currency for the customer based on their location. Using this together with a currency switcher will make it easy for customers to change their currency with selectors, if they wish to.

Shopify have their own Geolocation app for this, although styling and customization is limited.

Shopify Multi-Currency Backend

When Shopify Payments and multi-currency are enabled, you will see a currency section once you go in to ‘Manage’ on Shopify Payments. You’ll then see each enabled currency.

Setting Currency Conversions

When it comes to converting your currency with Shopify Payments, you have two options: automatic currency conversion and manual exchange rate conversions.

Automatic Currency Conversion

When you sell in multiple currencies, your online store prices are converted to your customer’s currency. The prices in your store change automatically with market exchange rates. You can’t set prices for your products manually in different currencies.

Your prices are converted by multiplying the store price by the currency conversion rate, adding the conversion fee, and then applying the rounding rules for that currency if applicable. Your converted prices include your currency conversion costs.

For example, when a $10.00 USD product is converted to Euros, the converted price of €8.90 includes the currency conversion rate and conversion fee:

(Product price x currency conversion rate) x (1 + currency conversion fee)

($10.00 USD x 0.867519) x (1 + .015) = €8.81

If you have rounding rules enabled, then the total is rounded up to €8.90

Manual Exchange Rate Conversion

On the Shopify, Advanced Shopify, and Shopify Plus plans, you can set the exchange rate manually. This allows you to lock in a fixed rate for each currency you have enabled, and you won’t have to worry about fluctuating exchange rates. Your prices won’t change with the market rates.

When using manual conversion rates, you might gain or lose money depending on your variance against current market exchange rates .A conversion fee applies to your currency conversion. If you want to include this fee in your manual rate, then multiply your rate by the conversion fee for your store’s country.

For example, a USD to EUR exchange rate with a 1.5% conversion fee might look like this: 0.90867 x 1.015 = 0.9223.

You can enable manual rate conversions from your Shopify Payments settings by following these steps:

- From your Shopify admin, go to Settings > Payments.

- In the Shopify Payments section, click Manage.

- In the Currencies section, click Edit next to the currency you want to edit.

- Select Use a manual rate.

- Click Save.

Rounding Rules

Your prices can be rounded to avoid inconsistent price endings. Your converted prices change based on the currency exchange market, but the rounding rules help keep your prices stable. Rounding rules don’t apply to shipping rates or gift cards.

You can enable rounding rules, and preview converted prices from your Shopify Payment settings.

- From your Shopify admin, go to Settings > Payments.

- In the Shopify Payments section, click Manage.

- Then, in the Currencies section click enable for price rounding.

- In the Enabled currencies section click the currency you want to preview.

Getting Paid

Shopify will do the currency conversion for you before your payout, so you’ll receive your payout in the currency of the country where your store/business is located. Canadian businesses have the option for Canadian dollars (CAD) or United States dollars (USD). Danish businesses can be paid in either Euro (EUR) or Krone (DKK).

Shopify charge processing fees that vary depending on the card type and if it’s domestic or cross-border. You can ask for a breakdown of these from your Shopify Plus sales representative.

Can We Have Separate Domain and Sub-Domains for each Currency?

Shopify Payments can set additional regional domains and subdomains to display their store in the currencies (and languages) of specific regions. To do this, you can use both domain and sub-domains.

For example, you can configure a domain yourstorename.com to show the currency and language of wherever the majority of your customers shop from. Say that’s the US. When using that domain, your store will appear in English and USD. Similarly, if a lot of your customers shop from Spain, you might want to set a subdomain of es.yourstorename.com. Again, this will show your store in Spanish and EUR.

When your international customers search for your store, Google will return the domain variation that’s specific to their location. As Hreflang tags are automatically set up for all international domains.

This will make easier international shopping experience for your customers and help your grow your sales globally.

Is Shopify Multi-Currency Right for You?

To know if Shopify Multi-Currency is right for you or not you’ll have to read below.

1. Is Shopify payment right for you?

To use Shopify multi-currency, you need to be using Shopify’s own payment gateway called Shopify Payments.

Firstly, your business must be in one of the following countries: Australia, Austria, Canada, Denmark, Germany, Hong Kong SAR Chin, Ireland, Italy, Japan, The Netherlands, New Zealand, Singapore, Spain, Sweden, United Kingdom, and United States (excluding US territories except for Puerto Rico.)

Advantages of Shopify Payments over a ‘normal’ gateway:

- In-built fraud detection

- You can use Shopify Pay which is an accelerated checkout similar to Apple Pay

- Hassle-free automatic set up

Some of the drawbacks are:

- It’s relatively expensive compared to getting your own merchant account. Shopify Payments does offer a lot of features, so this needs to be offset against that.

- 3D secure not yet supported – though it will be soon due to the Strong Customer Authentication (SCA), which is part of the PSD2 directive in the EU.

2. Can you live without price control?

Shopify lets you set rounding up rules as described above, but it doesn’t let you set the price floor. Hence, lack of price control could be an issue whichever option you choose for currency conversion.

Automatic conversion price control:

Some businesses won’t like the idea of product prices changing day-to-day. Even with the price rounding, they might consider this to be too odd of an experience for their customers.

One more thing to note is that the currency conversion fee is included in any foreign currencies, which might serve to make them less competitive than other outlets where your products are sold.

Manual conversion price control

For those setting conversion rates manually, you’ll have more price control but this could still be an issue. For instance, some brands might wish to be able to follow manufacturers’ suggested retail prices for a product in a specific currency. But the manual conversion rate you set isn’t product-specific; it applies to all your products, meaning this wouldn’t be possible.

3. Are you interested in learning about your international customer base and their shopping habits?

Multi-currency is a great way to experiment with international selling without the hassle of a dedicated regional store. Moreover, multi-currency can help you decide which direction your international strategy should go in with slight commitment and development work. Once you know you have power in overseas markets you can look at using a more strong and flexible multi-store architecture.

4. Is currency/abandoned checkout really the problem?

Turning on multi-currency payments is not the only way of successful international selling. It’s just one part to help you understand what your global reach is, and use that information to expand.

Some other areas you need to consider in an international strategy are:

- Do you have localized marketing strategies?

- Do you accept local non-credit card payment methods?

- Is your site multilingual?

- Do you have competitive shipping rates?

5. You need multi-currency POS(Point Of Sale) or draft orders

Shopify POS only uses your store currency. You cannot sell in multiple currencies in any Shopify channels including the Wholesale channel, with Shopify multi-currency.

6. You don’t want Shopify to control when currencies are converted

Shopify will convert your foreign currency order revenue into your store currency at the same rate, whether you use manual or automatic currency conversion. There are four risk areas that can on your way:

- Manually captured payments: during the gap between authorizing and capturing the payment, the FX rate may have changed

- Refunds: during the gap between charging a customer and refunding them, the FX rate may have changed

- Chargebacks: during the gap between charging a customer and having to pay the chargeback, the FX rate may have changed

- Chargeback resolution wins: if you get a chargeback and you win the dispute resolution, you’ll have the payment captured again at the current FX rate.

In all the above mentioned cases, it can go either way. If the foreign currency gets stronger between authorizing and capturing the payment for example: you will receive less in your base currency when you get your payout — and vice versa. It’s not necessarily going to be a bad thing, yet it’s a level of risk.

However you deal with multi-currency, this will be the case. It’s also worth noting that not being able to control when your currencies are converted might be more of an issue for huge brands; these may find it beneficial to keep currencies in a different bank account then clear them through a broker when the exchange rate is in their favor, as opposed to having it converted in smaller quantities, at points determined by Shopify. But again, this level of control could open yourself up to even more risk if you don’t manage your currencies properly.

7. You need to accept SOFORT payments outside of Germany

SOFORT is a payment method widely accepted online in Europe, specifically in Austria, Belgium, the Netherlands, Germany, Poland, Italy, Spain, Slovakia, Switzerland, France, United Kingdom, Hungary and the Czech Republic.

It works on Shopify but only in Germany. You can learn more about Sofort from Shopify here. Shopify now also supports iDEAL, a Dutch payment method. It’s only available for businesses based in the Netherlands.

How to Setup Shopify Multi-Currency

If you are ready to setup Shopify multi-currency, here are the basic steps:

- Sign up for Shopify Payments, if you haven’t already.

- Enable multiple currencies in Shopify Payments.

- View and set up your converted prices.

- Add a currency selector to your storefront.

- Optionally, add geo-detection to locate your visitor and pick out the best currency for them.

- Don’t forget to consider gift cards and discounts in multiple currencies.

- Test and launch.

You can read Shopify’s official multi-currency instructions here.

Conclusion

Using Shopify multi-currency is a great step towards an international market and it will help you in the growth of your revenue and sales.

Shopify multi-currency feature has made it easy to make your website internationally strong and convenient for your customers to shop from your ecommerce store.